A quick answer for 2025: Amazon operates hundreds of fulfillment centers (FCs) worldwide, but most FBA inbound shipments for global sellers flow into major regional clusters—US West (California/Pacific Northwest), US Central (Texas/Illinois/Indiana), US East (New Jersey/Pennsylvania/Virginia), Canada (BC/ON/QC), and Europe (UK Midlands/Southeast, Germany’s NRW/Bavaria, France Île‑de‑France, Italy Lombardy/Emilia‑Romagna, Spain Madrid/Catalonia, Poland/Czech). Use this list to align your port of entry (e.g., LA/LB, NY/NJ, Rotterdam, Felixstowe), choose parcel vs. pallet routing, and plan inventory placement to minimize split shipments and cost.

Why warehouse location still matters in 2025

FBA is designed to be elastic: Amazon spreads inventory to reduce delivery time and shipping cost. For exporters, that elasticity turns into practical decisions—where to enter, how to route, and when to consolidate. Knowing the major FC clusters and common inbound rules helps you:

- Reduce inbound lead time and demurrage1

- Avoid appointment delays and rework

- Control placement fees and split shipments

- Map ports to FC clusters for ocean/air trade‑offs

Understanding Amazon facility types

Amazon runs several facility types; they impact how you plan inbound.

- Fulfillment Center (FC): Storage, pick/pack, customer orders. The core destination for FBA.

- Receive Center / Inbound Cross‑Dock (IXD)2: High‑volume intake and redistribution to FCs; sometimes used to alleviate FC capacity.

- Sortation Center (SC): Post‑FC parcel sort by geography; not for FBA inbound.

- Delivery Station (DS): Last‑mile staging; not for FBA inbound.

- Air Hub / Regional Air Gateway: Amazon Air for time‑sensitive moves; not a direct FBA intake point.

Tip: Your shipping plan defines the exact intake location. Use the facility list below to plan, but always follow the address and code in Seller Central.

2025 regional overview and representative FC codes

Note: Amazon adds/moves facilities frequently. The codes below reflect commonly assigned nodes seen by sellers and carriers; they are representative, not exhaustive. Always follow the ship‑to shown in your FBA shipment.

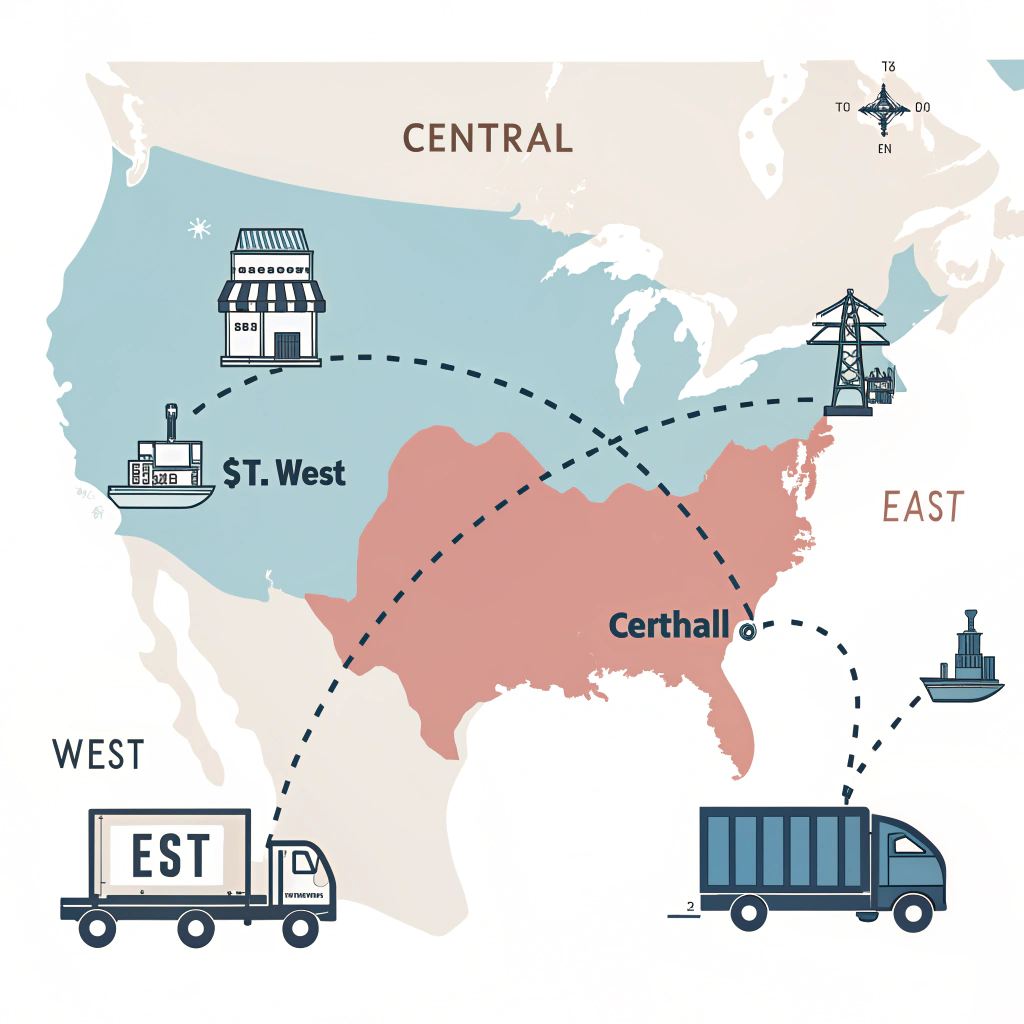

United States

-

West cluster (California, Pacific Northwest)

- Representative FC/Receive codes you may see: ONT8/9 (Ontario, CA), SBD1 (San Bernardino, CA), LGB8 (Long Beach, CA), LAX9 (Inland Empire, CA), SMF3 (Sacramento, CA), OAK4 (Tracy, CA), SJC7 (San Jose, CA), SEA6 (Kent, WA), PDX9 (Troutdale, OR)

- Primary ports of entry: Los Angeles/Long Beach (LA/LB), Oakland, Seattle/Tacoma, Portland

- Best for: Fast transload, Inland Empire palletization, West Coast DDP3 to reduce trucking miles

-

Central cluster (Texas, Midwest)

- Representative codes: FTW1/FTW6 (Haslet, TX), DFW7 (Coppell, TX), HOU2 (Houston, TX), IND9 (Plainfield, IN), MDW2/MDW6 (Joliet, IL), CMH2 (Etna, OH), STL8 (Edwardsville, IL)

- Primary ports: Houston (Gulf), New Orleans, rail from LA/LB to Dallas/Chicago, rail from East Coast into Ohio Valley

- Best for: Nationwide balancing, FTL/LTL hub‑and‑spoke, container rail to Dallas/Chicago then pallet delivery

-

East cluster (New Jersey, Pennsylvania, Virginia)

- Representative codes: EWR4 (Robbinsville, NJ), AVP1/AVP3 (Hazleton, PA), PHL4 (Croydon, PA), BWI2 (Baltimore, MD), RIC2 (Richmond, VA), CLT2 (Charlotte, NC), ATL6 (Stone Mountain, GA)

- Primary ports: NY/NJ, Norfolk, Baltimore, Savannah

- Best for: Pan‑East replenishment, dense population coverage, shorter truck lines from NY/NJ

Canada

-

West: YVR2 (Delta, BC), YYC1 (Calgary, AB)

- Ports: Vancouver, Prince Rupert

- Notes: Ideal for Western Canada; rail from Vancouver improves cost for heavier SKUs

-

Central: YYZ4/YYZ7 (Brampton/Mississauga, ON), YHM1 (Hamilton, ON)

- Ports: Toronto via CN/CP rail, Montreal for import then linehaul to GTA

- Notes: High volume; good for nationwide split from a single GTA intake

-

East: YUL2 (Montreal, QC), QC regional nodes

- Ports: Montreal, Halifax

- Notes: French labeling/compliance where applicable; avoid winter rail delays with buffer lead time

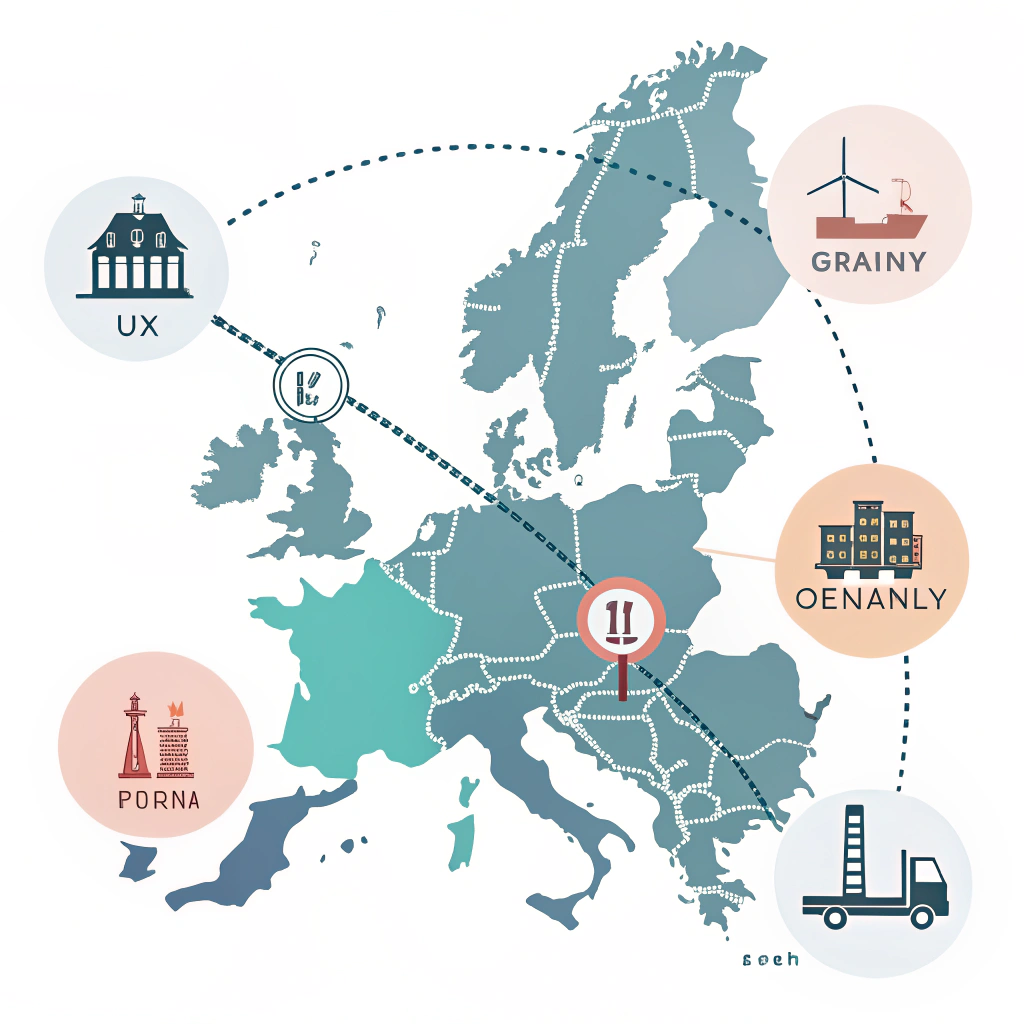

Europe (FBA Europe / Pan‑EU)

-

United Kingdom

- Southeast/Midlands: LCY2 (Tilbury, Essex), LTN1/2 (Dunstable), BHX4 (Rugeley), MAN2 (Manchester)

- Ports: Felixstowe, Southampton, London Gateway

- Use case: UK‑only or UK as spoke in Pan‑EU; strong carrier density for pallet inbound

-

Germany

- NRW/Bavaria/Saxony: DUS2 (Düsseldorf area), FRA7 (Frankfurt), LEJ1 (Leipzig), MUC area nodes

- Ports: Hamburg, Bremerhaven, Rotterdam (via road), Antwerp

- Use case: Pan‑EU central positioning; VAT and EPR must be in order

-

France

- Île‑de‑France & North: CDG area nodes, ORY vicinity, Lille logistics belt

- Ports: Le Havre, Antwerp/Rotterdam cross‑border road

- Use case: FR language/local compliance; DDP preferred to avoid customer delays

-

Italy

- Lombardy/Emilia‑Romagna: MXP (Milan area), Bologna logistics

- Ports: Genoa, Venice/Trieste

- Use case: Fashion/consumer goods; strong pallet carrier market

-

Spain

- Madrid/Catalonia: MAD area nodes, BCN (El Prat/Granollers)

- Ports: Barcelona, Valencia

- Use case: Seasonal smoothing to avoid Q4 congestion via Valencia

-

Poland/Czech

- Lower Silesia & Bohemia: WRO (Wrocław) area nodes; PRG (Prague) urban belt

- Ports: Gdansk/Gdynia; Hamburg/Rotterdam via road

- Use case: Cost‑effective Pan‑EU distribution eastward

Facility code patterns and what they imply

- Many FC codes reflect nearby airport IATA codes (e.g., ONT for Ontario, CA; EWR for Newark, NJ). The number suffix is internal. Treat codes as geographic hints, not guarantees.

- Fulfillment center (FC) destinations are your default FBA ship‑to. Sortation centers and delivery stations are not inbound addresses for sellers.

- Oversize and hazmat4 often route to specialized FCs. If you ship hazmat (dangerous goods), confirm DG eligibility during the shipping plan; non‑eligible FCs will be rejected.

Inbound modes and routing choices

Choosing the right mode is often the largest lever on total landed cost and lead time. Here’s how to compare.

- SPD (Small Parcel Delivery): Best for light SKUs, fast launch, flexible split across FCs. Carrier: Amazon partnered carrier or 3PL parcel.

- LTL (Less‑than‑Truckload): Best for palletized inbound, moderate volume. Appointment needed via Carrier Central. Lower per‑unit cost than SPD when cartons accumulate.

- FTL (Full Truckload): Best for single‑destination, large volumes to one FC or IXD. Highest scheduling complexity; strong cost/control when appointments are available.

- FCL/LCL (Ocean freight): Floor‑loaded containers are rarely accepted directly by FCs. Plan a transload to pallets at a near‑port warehouse, then LTL/FTL into FCs.

Table: Pros and risks by inbound mode

| Mode | Pros | Risks/Constraints | When to use |

|---|---|---|---|

| SPD | Fast, simple, low appointment risk | Higher unit cost; more split shipments | Launch/rapid replenishment, small/light ASINs |

| LTL | Good cost, pallet control | Appointment delays Q4; pallet specs strict | Regular restock, mixed SKUs on pallets |

| FTL | Best cost for volume | Single‑destination; hard rescheduling | Single FC/IXD intake; seasonal pushes |

| FCL/LCL | Ocean cost advantage | Must transload; adds handling time | High cube SKUs; steady demand with near‑port warehousing |

Pallet vs. parcel: the compliance checklist

Parcel (SPD)

- Box weight: ≤ 23 kg (50 lb). Boxes over ~15 kg should be “Heavy” labeled on each side.

- Labeling: FBA box labels on 4 sides preferred (minimum 2 opposing sides); scannable, not over seams.

- Carton contents: Provide box content information in Seller Central to avoid manual check‑in delays.

Pallet (LTL/FTL)

- Pallet spec (US): 48 x 40 inch GMA pallets, 4‑way entry, no overhang, sound deck boards. Height ≤ ~72 inches (1.8 m) including pallet; typical weight ≤ ~680 kg (1,500 lb).

- Pallet spec (EU): 1200 x 800 mm EUR pallets; similar height/weight constraints; confirm per country.

- Wrapping: Stretch‑wrap with top cover; use corner boards for stability.

- Labels: Pallet ID labels on at least 2 sides; carton FNSKU/barcodes inward‑facing ok if pallet ID is clear.

- Hazmat: Only to DG‑enabled FCs; ensure SDS5 and UN markings.

- Appointment: Book via Amazon Carrier Central; allow buffer time (3–7 days typical, longer in Q4).

Inventory placement and ASIN split rules

- Inventory Placement Service (IPS): Amazon can route most units to a single intake FC for a fee per unit. This reduces split shipments but adds cost. Best used for launches and when pallet economics outweigh fees.

- Distributed placement: Default behavior. Amazon will assign multiple FCs to balance delivery promise. Use this for mature SKUs with nationwide demand.

- ASIN attributes: Size tier, hazmat status, temperature sensitivity, and category can trigger assignment to specific FC types. Oversize often flows to specialized buildings; apparel and books can have category‑focused nodes.

Working practice: For new ASINs, enable IPS for the first wave to stabilize the listing quickly. For ongoing replenishment, switch to distributed placement and combine with multi‑stop LTL from a regional warehouse.

Port of entry and FC cluster alignment

Match ports to FC clusters to cut inland miles and appointments risk:

- West Coast to West FCs: LA/LB to ONT/SBD/LGB; Oakland to OAK/SMF; Seattle/Tacoma to SEA/PDX. Use dray + transload within 25–50 miles of port to minimize dwell.

- Gulf to Central FCs: Houston to HOU/DFW FTW; consider rail to Dallas/Chicago for high cube then palletize close to destination.

- East Coast to East FCs: NY/NJ to EWR/AVP/PHL; Norfolk/Savannah to RIC/ATL/CLT. Peak season: prefer Savannah/Norfolk when NY/NJ is congested.

- Europe: Felixstowe/Southampton to UK Southeast/Midlands; Hamburg/Rotterdam/Antwerp to DE/NL; Le Havre to FR; Barcelona/Valencia to ES.

How to use this list in real planning (step‑by‑step)

- Build the shipment in Seller Central to see assigned FCs. Note the codes and states.

- Choose port of entry that minimizes the sum of transit days + inland miles to those FCs.

- Decide mode:

- If assigned to 2–3 close FCs: LTL pallets are efficient.

- If assigned to many spread FCs: SPD or multi‑stop LTL from a regional warehouse.

- Confirm compliance:

- Box content info completed; FNSKU labeling done.

- Pallet spec meets region (48x40 US; 1200x800 EU).

- Hazmat/SDS verified; temperature control if required.

- Book appointments early:

- Create ASN and request delivery windows via Carrier Central.

- Keep flexibility: plan alternative dates and backup carrier.

- Add buffer:

- Q3–Q4: +7–10 days to appointment lead time.

- Rail repositioning: +3–5 days buffer for Midwest moves.

Common routing scenarios with sample outcomes

- China to US West, standard size apparel:

- Ocean FCL to LA/LB → near‑port transload to pallets → LTL to ONT8/SBD1 → check‑in within 3–5 days post‑appointment. IPS off to leverage distributed placement.

- China to US East, heavy item (oversize):

- Ocean to NY/NJ → palletize in Edison, NJ → FTL to EWR4 specialized oversize building → single‑destination appointment. IPS on for initial launch to avoid split.

- China to UK, Pan‑EU expansion:

- Ocean to Felixstowe → pallet to LCY2/Bedfordshire nodes → VAT/EPR compliant → enroll Pan‑EU → secondary transfer via Amazon to DE/FR ES. Use SPD for small replenishments to maintain buy‑box continuity.

Risk controls and what to avoid

- Floor‑loaded direct to FC: Avoid unless you have an approved receive center program. Transload first.

- Overweight cartons: Anything above ~23 kg risks refusal or manual handling delays. Split contents.

- Pallet overhang and broken boards: FCs can reject; rework fees add days.

- Appointment “no‑show”: Carriers with poor FC history face longer rescheduling. Use experienced LTL providers.

- Missing box content info: Triggers manual check‑in; delays can be 48–72 hours or more in peak.

Key takeaways

- Use the regional FC list to choose port and mode, not to override the shipping plan’s assigned ship‑to.

- Place inventory smartly: Inventory Placement Service for launches, distributed placement for scale.

- Respect inbound routing rules—choose SPD, LTL, FTL, or FCL based on cube and FC spread.

- Plan for appointments: Q4 congestion is real; early booking and flexible carriers are your best defense.

People Also Ask

Which country is best for Amazon sellers?

The United States is usually the most profitable due to demand and logistics density, but competition is highest. For expanding brands, the UK and Germany are the next most attractive: large markets, mature FBA infrastructure, and straightforward logistics via Felixstowe/Southampton or Hamburg/Rotterdam. Japan offers strong AOV with tighter compliance and language demands. UAE/Saudi provide fast growth in certain categories, though volumes are smaller. Choose a country where you can meet tax/EPR rules, secure reliable inbound (ports, carriers), and maintain lead times under 7–10 days for replenishment.

Where is the largest Amazon warehouse in the USA?

Amazon’s network changes often, and “largest” can mean total square footage or cubic storage. Multiple multi‑level robotics FCs in California’s Inland Empire (e.g., Ontario/San Bernardino) and large sites in New Jersey and Texas rank among the biggest by capacity. Sellers should treat these as major intake and redistribution hubs rather than target them specifically—your FBA shipping plan will assign the most suitable destination based on your ASINs and demand.

-

demurrage: Read to understand how port/rail storage fees accrue, how free time is calculated, and tactics (booking windows, drayage timing, chassis management) to prevent charges and reduce inbound costs. ↩

-

Inbound Cross‑Dock (IXD): Learn how IXDs intake and redistribute freight, when Amazon routes shipments through them, and how to plan appointments, packaging, and lead times for smoother intake. ↩

-

DDP: Delivered Duty Paid (Incoterms). See who is responsible for duties, VAT, and import clearance, how DDP affects customer experience and delivery speed, and when to choose DDP for Amazon FBA. ↩

-

hazmat: Review Amazon’s dangerous goods requirements, eligibility checks, packaging/label standards, and documentation to avoid FC rejections and delays for regulated products. ↩

-

SDS: Safety Data Sheet. Learn how to prepare and submit compliant SDS (GHS format, sections, classifications) so Amazon can validate DG eligibility and accept your inbound shipments. ↩