Cost, Insurance & Freight (CIF) is an important Incoterm1 widely used in international sea freight contracts. Under CIF, the seller assumes responsibility for the cost of goods, marine insurance, and freight charges to deliver the shipment up to the named destination port. Meanwhile, risk transfers from seller to buyer once the goods are loaded onto the vessel at the port of shipment. For importers, understanding CIF is vital to properly managing costs, risks, and logistics expectations in global trade.

This guide explains CIF shipping terms from the perspective of freight forwarders and importers. You will learn what costs are included, who handles insurance, where risk transfers, and how to optimize your supply chain2 under CIF terms.

CIF, or Cost, Insurance, and Freight, is a contract term defined in Incoterms 2020 specifying that the seller pays for the cost of goods, freight to the destination port, and minimum marine insurance for the shipment. CIF applies strictly to sea or inland waterway transport.

The key elements of CIF include:

- Cost: The seller’s goods price and all related charges up to loading on board.

- Insurance: The seller must procure a marine insurance policy covering at least 110% of the contract price.

- Freight: The seller pays for freight charges to the agreed destination port.

- Risk Transfer: Risk passes to the buyer once goods are loaded on board the vessel at the port of shipment.

In practice, this means the importer is not responsible for transportation or marine insurance costs until the goods are onboard the ship. However, once loaded, the buyer assumes all risks, including losses or damage during transit.

To clarify the obligations under CIF terms, here is a simple breakdown of seller and buyer responsibilities:

| Responsibility | Seller (Exporter) | Buyer (Importer) |

|---|---|---|

| Goods preparation | Manufacture or procure goods | Inspect goods on arrival |

| Export customs clearance | Handle and pay export clearance fees | Provide necessary documents for import |

| Shipment booking | Arrange and pay freight | Receive goods at destination port |

| Packaging & marking | Properly package goods for shipment | Unload and transport from destination port |

| Marine insurance | Buy insurance covering 110% of contract | Optionally buy additional insurance |

| Risk transfer point | When goods loaded on vessel at origin port | From vessel loading onward |

| Delivery cost & risk | Up to destination port | From destination port onwards |

CIF clearly states the seller includes freight and minimum insurance costs in the quoted price. For importers, this simplifies upfront cost negotiations because the freight and insurance prices are bundled with the goods cost.

However, importers should be aware:

- The insurance provided is minimum coverage (usually 110% of contract value), which may not fully cover high-value or high-risk products.

- Additional insurance may be required and arranged by the buyer for enhanced protection beyond CIF insurance.

Risk transfer under CIF happens at the loading port, not at destination. This means:

- Loss or damage during the sea voyage is technically the buyer’s responsibility.

- The insurance purchased by the seller protects the buyer only if a claim arises, but the buyer must be proactive with claims and cargo inspections.

3. Freight Forwarder3 Role

A professional freight forwarder adds value under CIF by:

- Coordinating shipment bookings with carriers.

- Ensuring proper cargo documentation and customs clearance.

- Advising importers on supplementing insurance coverage.

- Tracking shipment progress and managing inbound logistics.

- Offering door-to-door services extending beyond CIF destination port.

FOB (Free On Board) is another common Incoterm, and importers often weigh CIF vs FOB when deciding shipping terms.

| Aspect | CIF | FOB |

|---|---|---|

| Seller Pays Freight? | Yes, up to destination port | No, buyer pays freight |

| Seller Pays Insurance? | Yes, minimum marine insurance included | No, buyer arranges and pays insurance |

| Risk Transfer Point | When goods loaded onboard at origin port | When goods loaded onboard at origin port |

| Buyer’s Cost Control | Less control over freight & insurance cost | More control, but more responsibility |

| Best For | Buyers preferring simplified, prepaid freight and insurance | Buyers wanting control over freight & insurance |

For importers seeking to reduce logistical complexity and upfront freight insurance arrangements, CIF is often preferred. Those with strong logistics capacity and carrier relationships may opt for FOB to control freight costs.

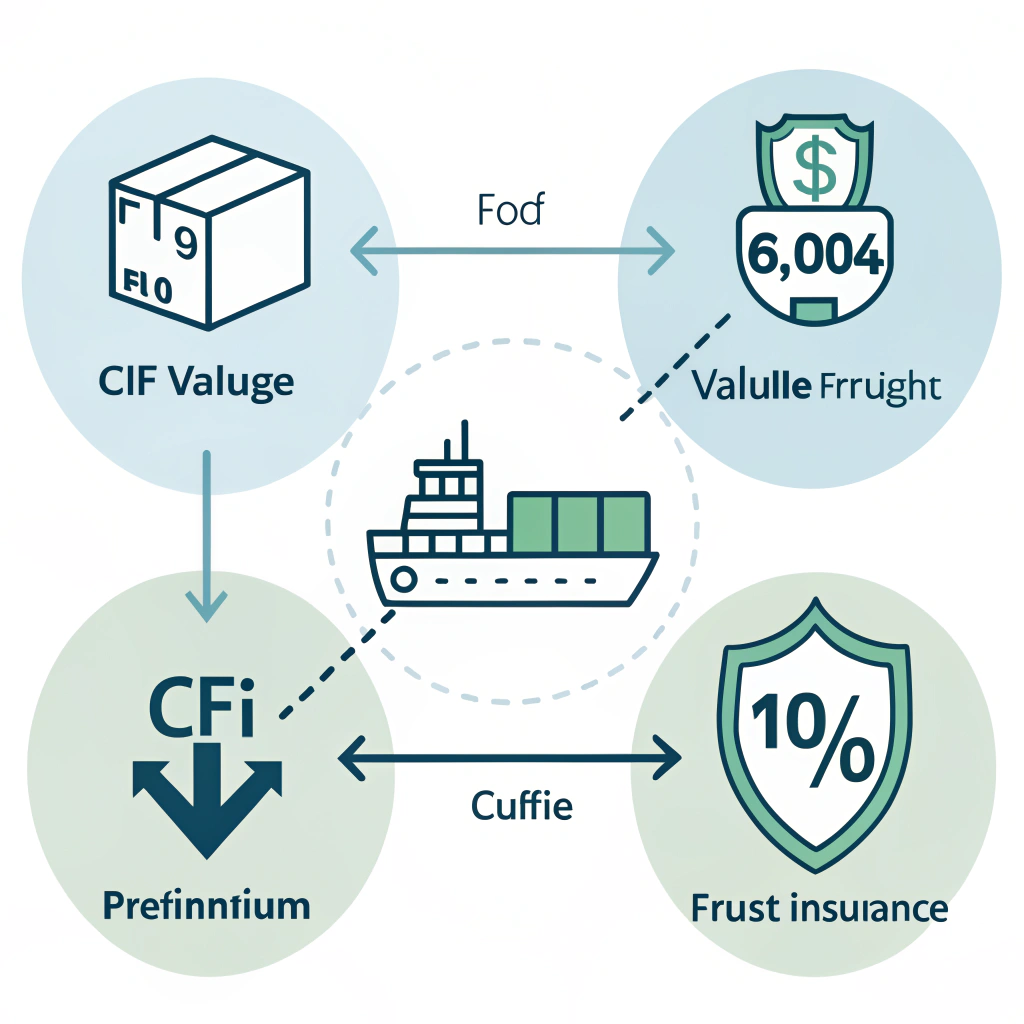

The CIF price calculation formula usually looks like this:

CIF Price = FOB Value + Freight Cost + Insurance Premium

- FOB Value: Cost of goods plus export loading costs.

- Freight Cost: Charge from port of origin to destination port.

- Insurance: Minimum 110% of FOB value plus freight, based on marine insurance rates.

This formula helps importers compare supplier quotes and understand what part of total cost covers freight and insurance.

- Verify Insurance Coverage: Ensure the insurance policy meets your cargo value and risk profile. Negotiate additional insurance if necessary.

- Understand Risk Transfer: Remember, risk passes once goods are loaded on the vessel. Loss or damage during ship transit impacts you.

- Communicate with Freight Forwarder: A trusted freight forwarder bridges gaps in CIF shipments, handling clearance, documentation, and inland delivery.

- Get Detailed Cost Breakdowns: Ask sellers for the CIF cost breakup to identify freight and insurance portions.

A U.S.-based electronics importer sourced components from Shenzhen. Using CIF terms, the Chinese supplier:

- Sold goods including freight and insurance to Los Angeles Port.

- Coordinated booking with shipping lines.

- Purchased 110% minimum marine insurance covering damages during transit.

The importer benefited by paying a single CIF price covering freight and insurance, reducing logistics overhead. Their freight forwarder handled customs and inland trucking after arrival, ensuring smooth supply chain flow.

CIF (Cost, Insurance & Freight) terms offer importers a convenient way to shift the freight and insurance responsibilities to the seller while maintaining responsibility for goods risk once loaded onto the vessel. Knowing the cost components, risk transfer point, and insurance scope under CIF empowers importers to negotiate better contracts and manage global shipments efficiently.

Our recommendation:

- Use CIF when you want the seller to handle freight and insurance to the destination port.

- Work with a professional freight forwarder to ensure seamless clearance and inland transport after arrival.

- Always verify insurance adequacy and consider supplemental coverage for high-value goods.

Mastering CIF terms will empower your global import business with smoother logistics and optimized supply chain costs.

Q1: How much is insurance in CIF?

Under CIF terms, the seller is required to provide cargo insurance covering at least 110% of the contract value of the goods. This coverage protects against possible loss or damage during sea transit. However, for high-value or sensitive shipments, this minimum coverage may not be sufficient, and importers should consider additional insurance to fully secure their interests.

Q2: Who pays for insurance in CIF transaction?

In a CIF transaction, the seller pays for the marine insurance as part of their obligation. The seller must arrange and pay for insurance that protects the buyer against cargo loss or damage during shipment up to the destination port. The buyer assumes risk from the point goods are loaded onboard the vessel.

Q3: How is CIF insurance calculated?

CIF insurance amount is generally calculated as 110% of the FOB value plus freight cost. The formula is:

CIF = FOB Value + Freight + Insurance (110% of FOB + Freight)

This ensures the insurance covers not only the value of goods but also freight costs, offering broader protection during sea transport.

-

Incoterm: Reading the article helps you understand internationally recognized commercial terms that define responsibilities, costs, and risks between buyers and sellers in global trade. This knowledge clarifies contract obligations and reduces disputes. ↩ ↩

-

Supply Chain: Learning about supply chains helps importers optimize product flow from production to delivery, reduce costs, and improve reliability in global logistics operations. ↩ ↩

-

Freight Forwarder: Discovering the role of freight forwarders shows importers how professionals coordinate shipments, handle customs, manage logistics, and provide value-added services for smoother international trade. ↩ ↩